AI isn’t a future trend in trucking anymore. It’s already part of the software and systems moving freight every day. From inbox automation to fraud detection to smarter load matches, AI is quietly changing work behind the scenes and drivers are starting to feel the benefits.

If you want a deeper look at the technology itself, start with our AI in trucking overview. Here, we focus on who’s using AI today and why it matters.

How Brokers Use AI

Brokers use AI to move faster. Some of the biggest brokers in freight are using AI to automate repetitive tasks like quoting, order handling, and tracking so their teams can focus on decisions.

For example, C.H. Robinson has built more than 30 AI agents that handle routine shipping tasks like price quotes, classification, order processing, and shipment tracking, cutting down manual work and speeding up responses.

Why this matters for owner operators:

Faster responses on load offers

Less waiting for confirmations

Fewer messages lost in email chains

What this means for your day to day:

When brokers automate repetitive tasks, it makes communication with drivers quicker and clearer, especially in high-volume markets.

How Carriers Use AI

Carriers use AI to spot patterns and rates shift faster. For example, some carriers and logistics companies may use AI-powered analytics to identify trends in demand and pricing so they can adjust rates or reposition capacity faster.

Reports show that load boards and analytics platforms now use predictive tools to help carriers and brokers identify shifts in freight patterns and pricing dynamics.

Why this matters for owner operators:

Rate movement shows up faster on load boards

Certain lanes tighten or loosen more quickly

Good signals help you pick better loads

What this means for your day to day:

Even if you don’t subscribe to every analytics dashboard, AI-driven signals are shaping what’s available and when it becomes available.

How Dispatch Work Is Getting Automated

Both small and large operations teams are using AI to help with high-volume tasks like sorting load emails, building confirmations, and processing documents. These tools don’t replace humans. They help cut down background busywork so real problems get solved faster.

Why this matters for owner operators:

Fewer load offers lost in overflowing inboxes

Faster confirmations from dispatch teams

Less time spent on routine back-and-forth

How Freight Platforms & Market Infrastructure Use AI

There’s another group using AI that isn’t a broker or a carrier: the freight platforms and marketplaces that power load boards and network infrastructure. These tools often sit between brokers and carriers and use AI for trust, risk detection, and marketplace quality.

Identity Verification & Fraud Detection

Fraud and identity risk have become major threats in the freight world. To combat this, freight marketplaces like DAT Freight & Analytics have introduced AI-powered identity verification and fraud detection systems. These systems monitor login behaviors and account activity to prevent unauthorized access and stop fraud before it impacts carriers or brokers.

These AI systems can automatically detect suspicious login patterns and block fraudulent attempts, an important protection given the prevalence of identity-related fraud in freight networks.

TruckSmarter also helps drivers reduce risk by verifying which brokers are factorable before you book, giving you a clear signal on who’s been vetted and who hasn’t. It’s a simple check that can help drivers avoid bad actors before a load ever gets booked.

Why this matters for owner operators:

Fewer fake carriers and double brokering scams

More confidence that the loads you see are real

Market Signals & Predictive Insights

Freight platforms also use data analytics and predictive tools to help users see broader market signals. These insights are fed into load boards and analytic dashboards so brokers and carriers can spot trends in pricing, demand, and capacity.

Why this matters for owner operators:

Cleaner marketplaces and better quality signal

Fewer wasted searches or mismatched offers

How Load Boards Are Using AI Today

Today’s load boards are integrating AI to help refine search results, show better matches, and cut down on manual searching and scrolling.

Load boards, like TruckSmarter’s free load board shows what’s available. AI-powered tools like Dispatch, TruckSmarter’s load board assistant, upgrades the experience by helping you sort, verify, and act on the loads that fit your preferences.

Why this matters for owner operators:

Better verified matches instead of scrolling forever

Fewer irrelevant offers

Loads that fit your lane and schedule

Less time spent on administrative tasks

Here’s how Dispatch helps:

Calling Assistant handles phone trees and hold times

Bid & Book fills in load details so you can contact brokers fast

Search Feedback suggests tweaks when results are thin

Personalized Load Matching learns your route and load preferences

Email Assistant scans and sorts load offers in your email to surface them on your load board so you don't miss an opportunity

The main takeaway here is that automation saves time and lets you focus on good freight, not busywork.

The Bigger Picture

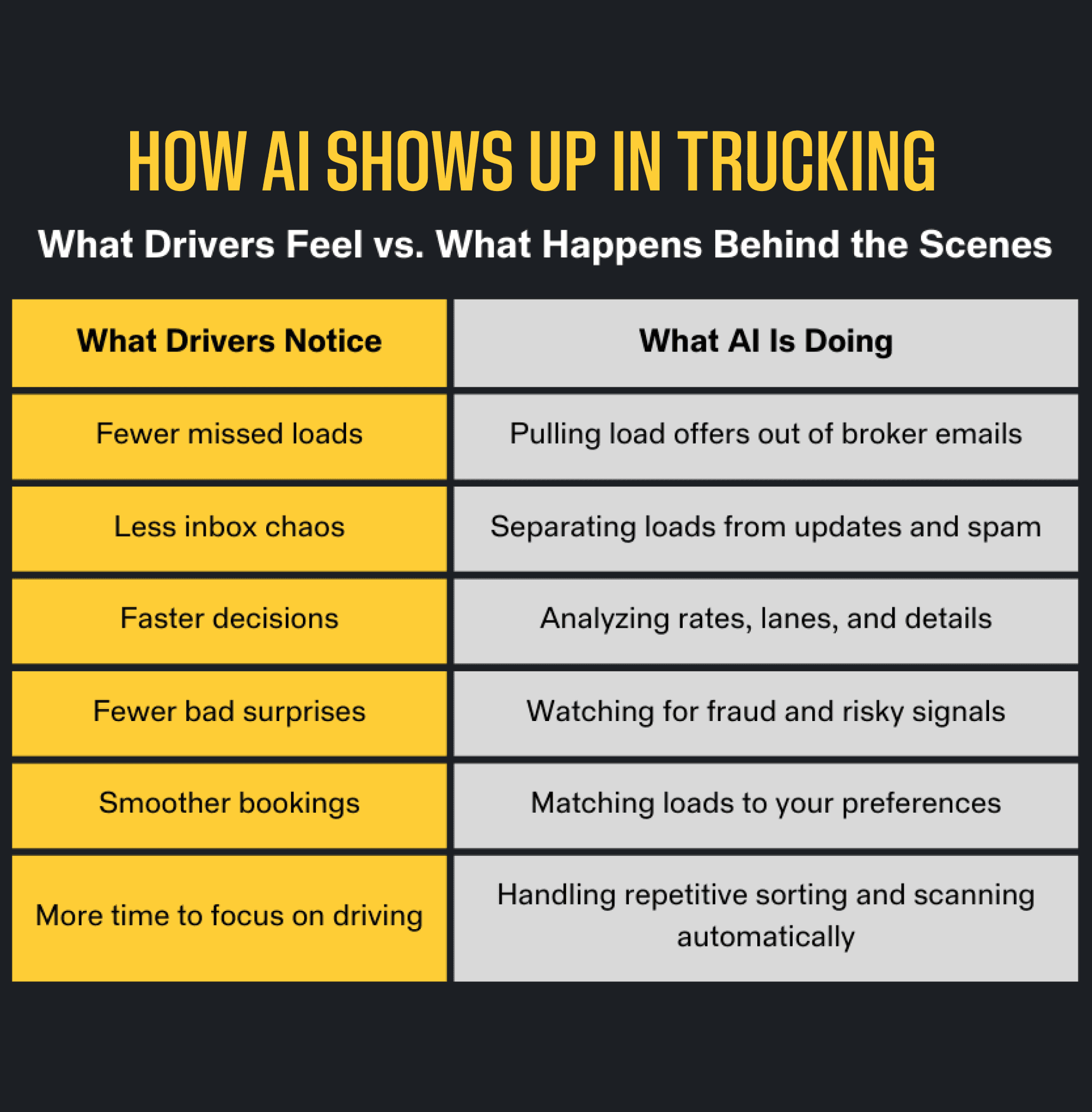

AI adoption in trucking is a quiet shift. The industry still runs on judgment, experience, and relationships. What’s changed is how much of the busywork is being handled by technology in the background.

For independent owner operators, that means:

Better visibility into load options

Faster confirmations

Less inbox noise

More reliable load matches

Running your own trucking business means wearing every hat. Dispatch helps cut down the time spent scrolling load boards or waiting on brokers—saving you up to three hours a week by automating your workflow. Start a free 30-day trial and see how Dispatch fits into your day.

Written by

🚚 Save time finding loads with Dispatch

🔍 Learn about our 100% free load board

Share this content