2026 is shaping up to be a year of stability in trucking where the market is settling into a new normal. For owner operators, stability doesn’t mean easy money though.

Rates aren’t crashing, but they aren’t climbing much either. Costs are still high, capacity remains uneven by region, lane, and equipment type, and disruption is now part of everyday operations. This isn’t a market where waiting for a rebound fixes margins. Opportunity exists, but it favors owner operators who stay disciplined, selective, and strategic.

Here’s what’s shaping the 2026 trucking outlook and what it means for independent drivers.

2026 in Freight: Stable, Still Competitive

The freight market heading into 2026 looks more stable than the past few years, but is still very competitive. Industry analysts, including reporting from FreightWaves, DAT, and ACT Research, generally say we can expect a gradual market reset over a sharp rebound. While shipping demand has picked up a bit and some routes are getting crowded, freight prices haven't changed much overall.

Here’s what this means for your business:

Capacity is exiting, but unevenly by lane, region, and equipment

Freight demand is steadier, not explosive

Rates are holding, not climbing fast

Volume alone won’t fix margins

Is the trucking market getting better in 2026?

In some ways, yes. The market is more predictable than it was during peak volatility. But, competition is still intense and discipline matters more than ever. For owner operators, industry veterans say profits in 2026 are less about catching a market swing and more about controlling what’s within reach: load selection, downtime, and preventable costs.

If freight isn’t booming, the next question is why it can still feel so tight.

Overcapacity’s Lingering Impact

Despite capacity exits over the past year, there are still too many trucks chasing too little freight. As Overdrive has reported, overcapacity continues to pressure rates and keep competition high.

Here’s what’s driving the 2026 market:

New truck orders remain weak, limiting fresh capacity

Aging equipment may force some exits later in the year

Smaller, less efficient operators are under the most pressure

This creates a slow shakeout rather than a clean break. Capacity exits can help, but they don’t immediately translate into higher rates.

2026 Trucking Outlook: What Owner Operators Should Prepare For

Will freight rates go up in 2026?

Rates may improve in some lanes or at certain times of year, but most drivers shouldn’t expect a big, lasting increase right away. Any real upside is more likely later in the year, and only if there are fewer trucks on the road. For owner operators who can make it through the slower periods, there may be opportunity ahead. But getting there takes more than waiting on rates. That’s where costs come in.

Cost Pressure Shapes Survival

If 2026 has a theme, it’s cost control. When freight rates are steady instead of strong, margins live or die on expenses you can manage. Fuel, insurance, maintenance, financing, and downtime all add up quickly. Some drivers are frustrated that expenses keep climbing while rates haven’t followed, making every decision feel higher-stakes than it did a few years ago.

Here’s where you have more control:

Cutting preventable maintenance costs has a direct impact on take-home pay

Reducing empty miles protects margins even when rates don’t move

Building strong broker relationships to get access to better loads

Staying compliant to avoid costly fines and stay on the road

Time savings matter just as much as rate increases

Is it still worth being an owner operator in 2026?

For many drivers, yes. But it depends on how you run your business. Owner operators who stay on top of controllable costs and avoid running unprofitable freight can still make it work. Drivers waiting for higher rates to do the lifting may struggle.

Cost discipline helps protect margins, but it doesn’t eliminate disruption.

Disruption Is the Baseline

Disruption is no longer an exception in trucking. It’s the operating environment. Weather events, policy shifts, geopolitical tensions, and spot-market volatility continue to impact lanes and timing. Forecasts help, but flexibility matters more than perfect predictions.

In 2026, owner operators can expect:

Spot rates will go up and down, and that’s normal

Lanes can shift quickly because of things outside their control

Being able to adjust matters more than sticking to one fixed plan

Drivers who can pivot routes, timing, or strategies stay ahead of those who wait for clarity that never fully comes. This is where better information and smarter workflows start to matter.

Making Strategic Decisions in 2026

The edge in 2026 doesn’t come from complexity. It comes from clarity.

Strong owner operators are focusing on:

Fewer, better loads that fit their lanes, equipment, and rate floor

Keeping deadhead down and avoiding time-wasting broker calls

Using tools that save time and help them decide faster

In a steady but competitive market, consistency wins. Running loads that make sense for your operation, cutting wasted miles, and limiting distractions all protect margins.

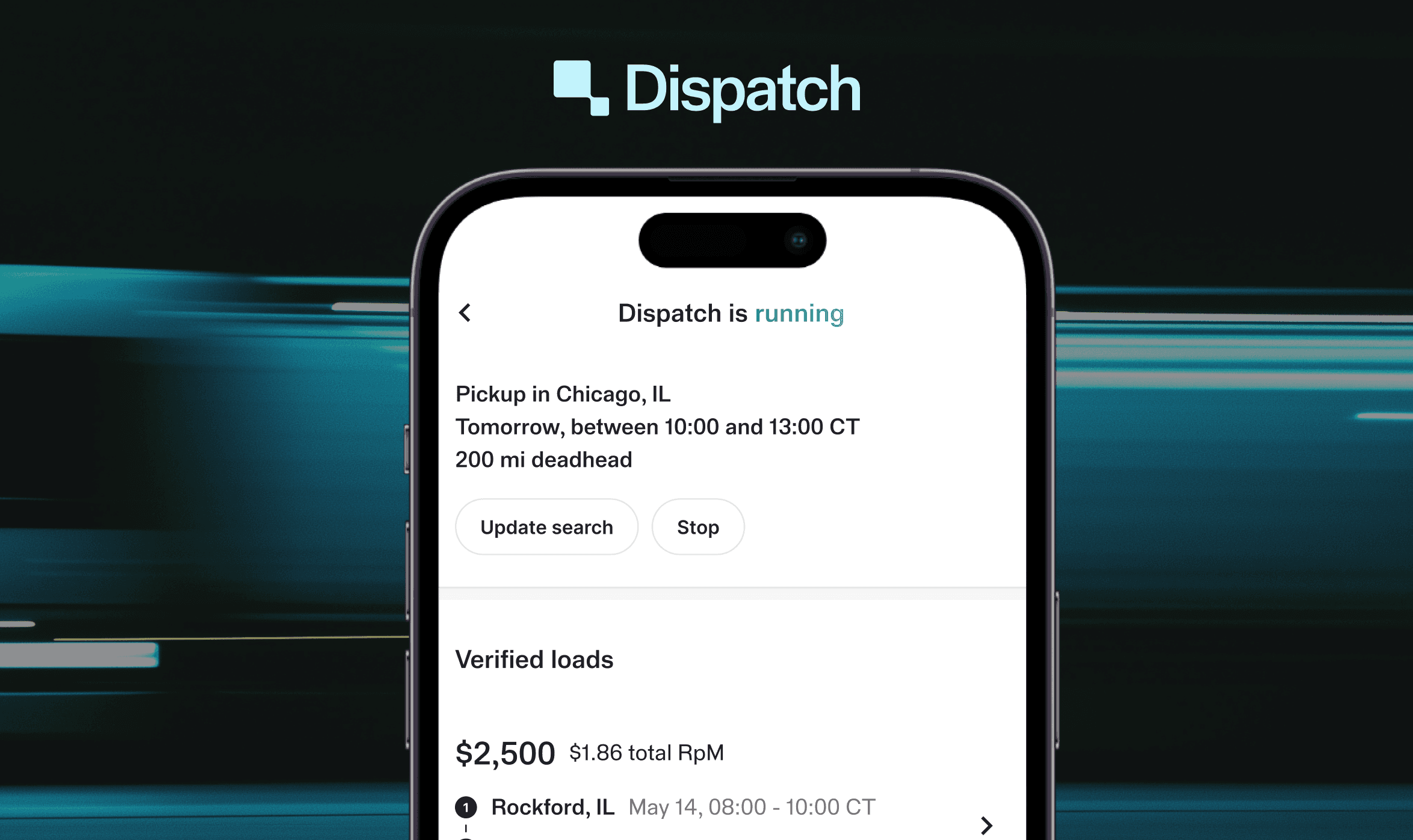

This is where tools like TruckSmarter’s free load board and Dispatch, our AI-powered load board assistant, can support smarter decision-making without taking control away. The goal isn’t more screens or more scrolling. It’s getting better information faster, so you can book with confidence and keep moving. Clear decisions and tight operations won’t eliminate disruption, but they make it easier to handle.

The final word

The 2026 trucking outlook isn’t about big growth. It’s about staying steady, being disciplined, and adapting as conditions change. Capacity is still uneven, costs are high, and disruptions are part of the job. But owner operators still have control. Drivers who stay selective, protect their margins, and make intentional decisions are better positioned day to day.

Stay informed, stay disciplined, and use tools that save time and help you focus on the loads that make sense for your business. TruckSmarter’s free load board connects you with verified brokers, while Dispatch helps you confirm details and book the right freight faster.

Try Dispatch free for 30-days to save time and book loads faster now.

Written by

🚚 Save time finding loads with Dispatch

🔍 Learn about our 100% free load board

Share this content